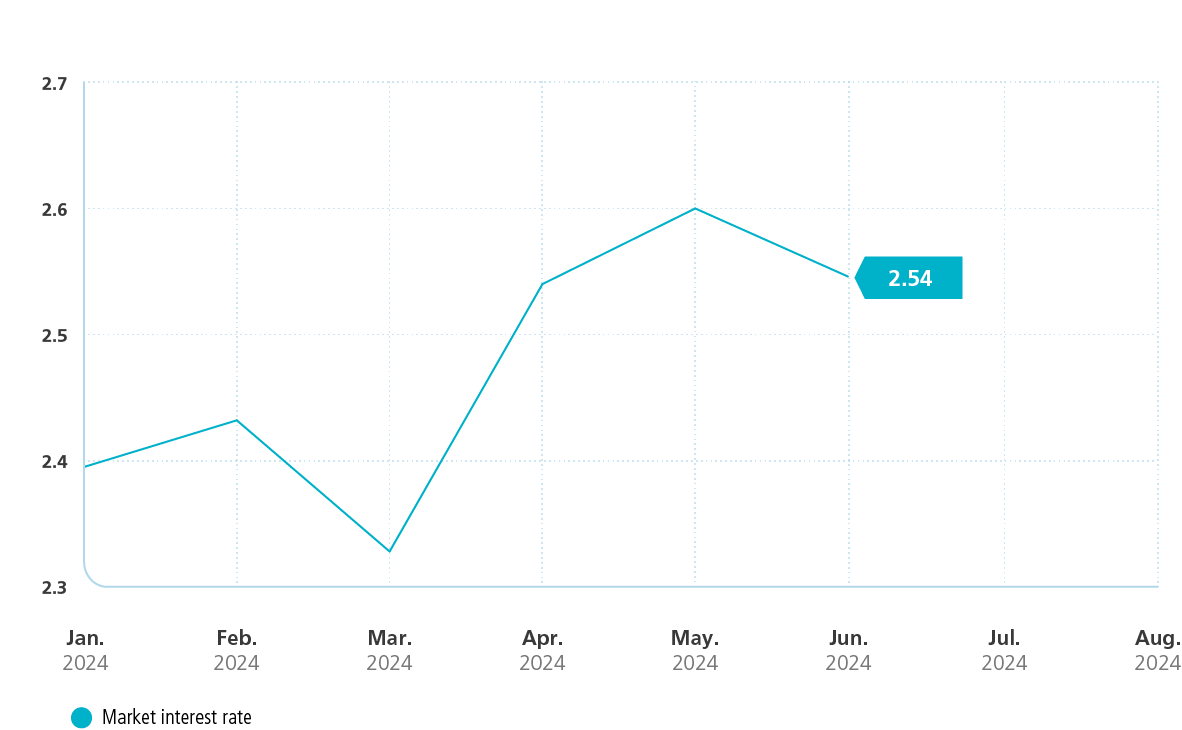

Interest rates continue in upward trend

High interest rates are good for your pension

We are now halfway into 2024 and are already looking ahead at how your pension will develop in 2025. Will we be able to increase your pension to keep up with inflation? And will the 30.5% pension contribution be sufficient to ensure your pension accrues at the maximum level allowed?

A lot will depend on the interest rates that pension funds apply in order to calculate the discounted present value of their 30-year commitments. By the end of the second quarter, the 30-year rate had risen to 2.5%.

High interest rates are beneficial to your pension. This is because the discounted present value of the commitments decreases more than the losses incurred on bonds. The net effect is that the funding ratio rises, which means we can increase your pension.

The opposite is the case when interest rates are low. In that situation, indexation and accrual of your pension are under pressure. At the end of the year, we will be able to inform you about the actual situation.

This quarterly report has been carefully prepared. The final figures for 2025 will be published in the anual report. You cannot derive any rights from this report.