Funding ratio declined in third quarter

''Early in 2025, we will inform you about the indexation of your pension''

The funding ratio is the ratio between the pension fund’s assets and its commitment to pay out pensions now and in the future. Interest rates are not the only elements affecting this ratio. The return we make on our investments play a role as well.

In the third quarter, interest rates came down. The value of our equity investments rose. We also studied the mortality rates of the pension fund's participants. The study revealed that our participants are living longer than we had anticipated. This means the pension fund's pension commitments are higher than previously assumed. And that has a negative effect on our funding ratio.

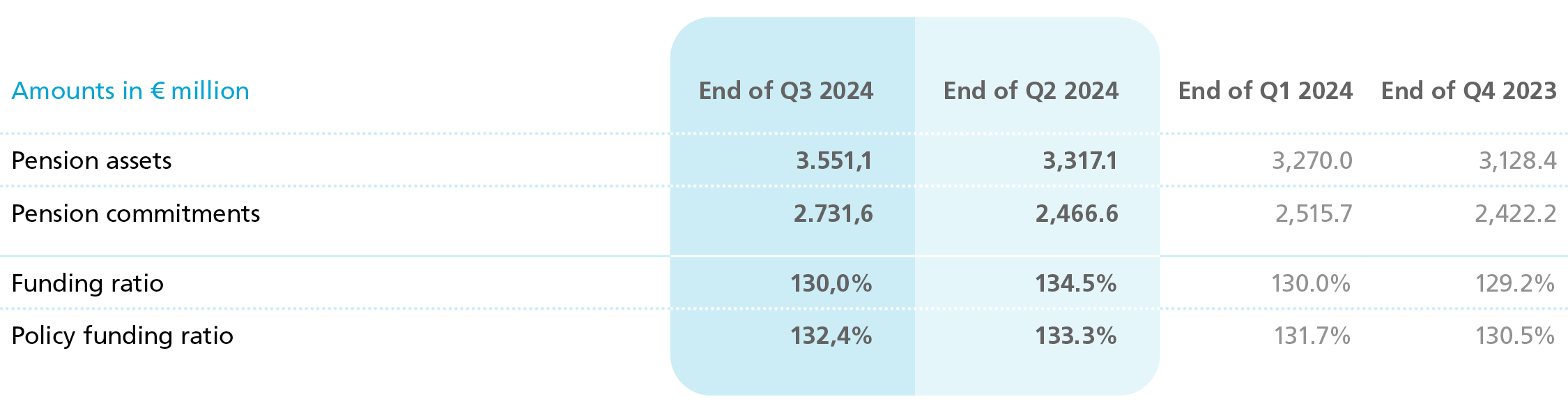

On balance, the fund's current funding ratio decreased by 4.5% in the third quarter and the policy funding ratio came down by 0.9%.

Development funding ratios

The policy funding ratio is equivalent to the average funding ratio for the preceding 12 months. It determines the level of indexation we are allowed to apply to your pension. As a rule of thumb: the higher the policy funding ratio rises above 110%, the more we will be allowed to increase your pension. Increasing your pension (indexation) is important because it ensures your pension retains its purchasing power.

If and how much indexation we will be applying to your pension is a decision our board will make at the end of the year. We will inform you about this in early 2025.

This quarterly report has been carefully prepared. The final figures for 2025 will be published in the anual report. You cannot derive any rights from this report.