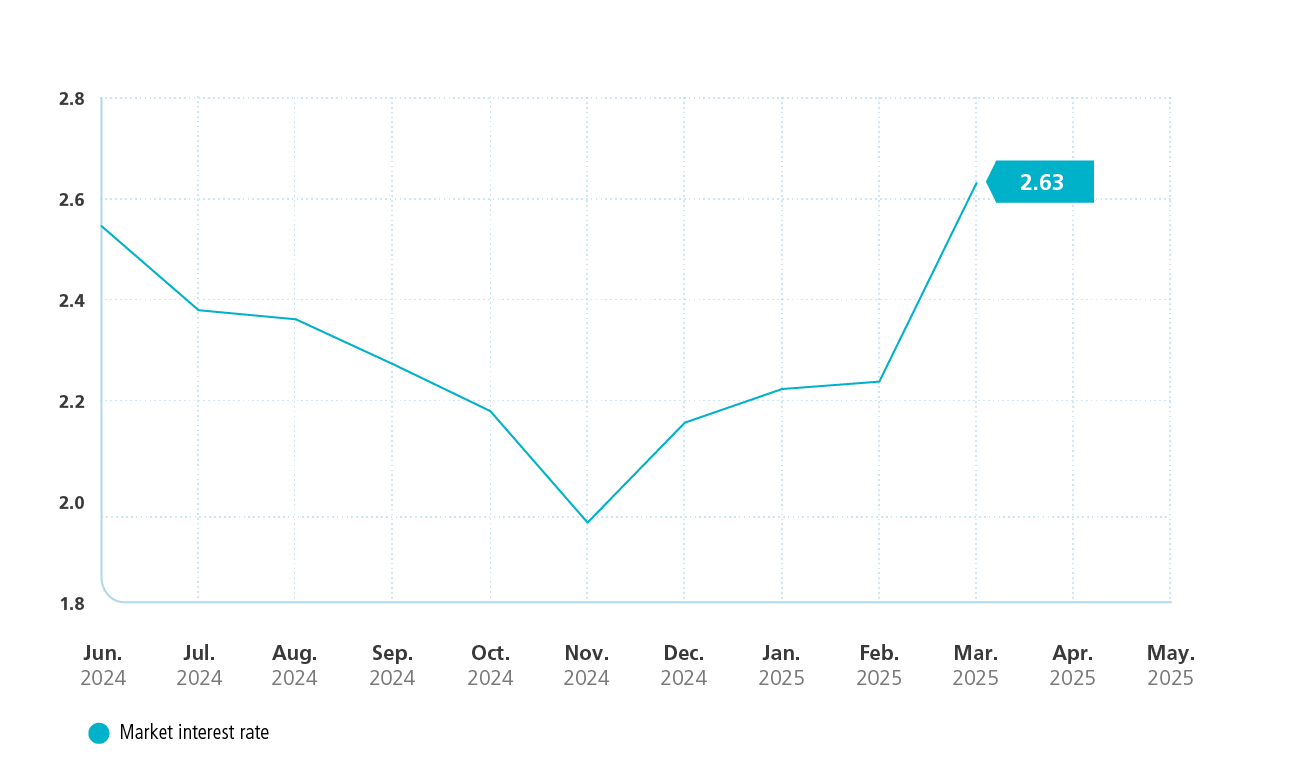

Interest rates rose in the first quarter

“Interest rates affect your pension in the future”

How will your pension develop in 2025? Will we be able to increase your pension to keep up with inflation? And will the 30.5% pension contribution be sufficient to ensure your pension accrues at the maximum level allowed? That is indeed the case. Read about it here.

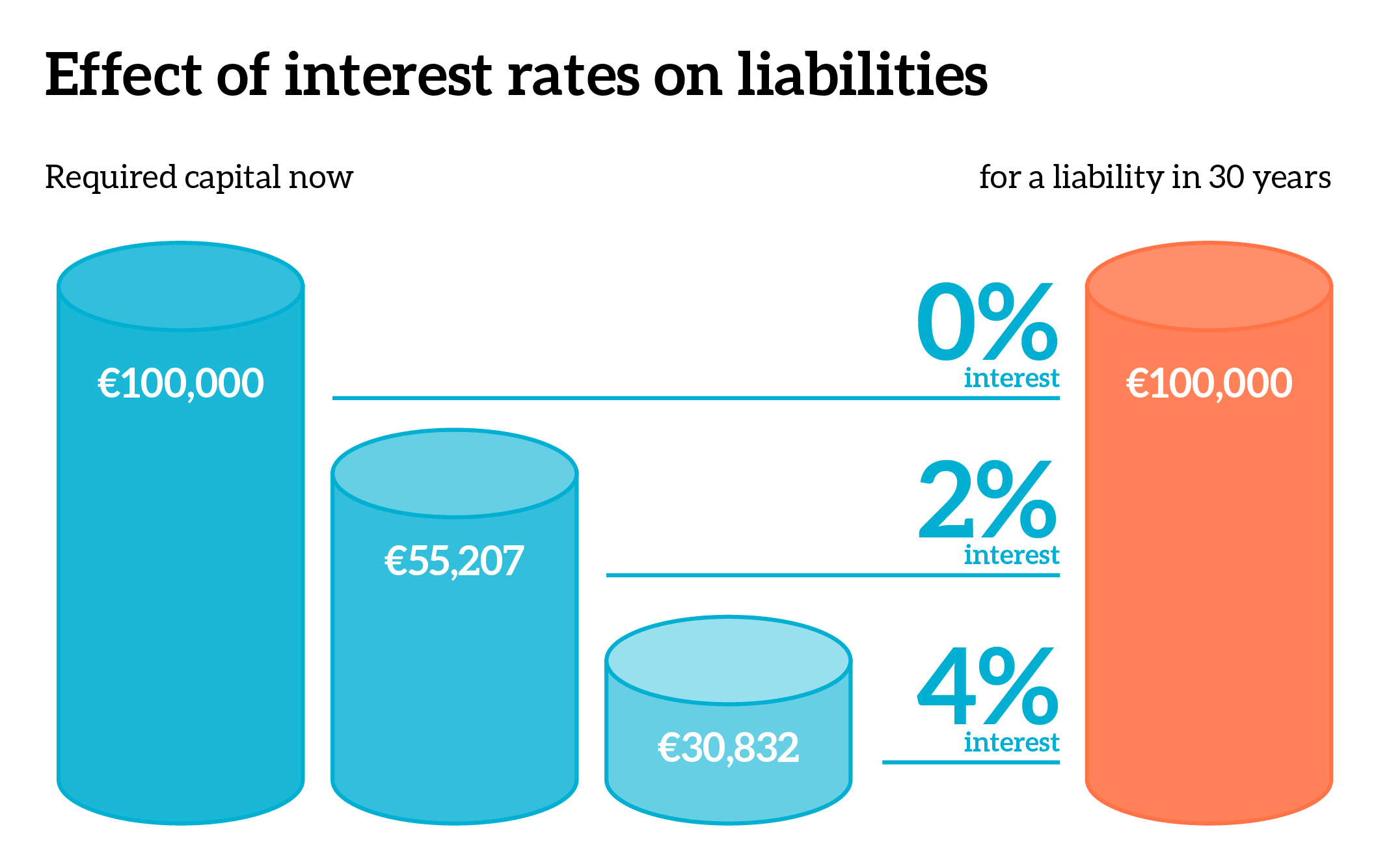

Much depends on the interest rates that pension funds use to discount their future commitments to their present value. The pension payments we have to make lie mostly far in the future. The 30 year swap rate is the most important interest rate. This interest rate rose from 2.16% to 2.63% in the first quarter.

Because the commitments are not fully hedged, higher interest rates are beneficial for the funding ratio. This is because the value of future commitments falls more sharply than the losses on the investments in the matching portfolio and we consequently have more money left to pay your pension in the future.

This quarterly report has been carefully prepared. The final figures for 2025 will be published in the anual report. You cannot derive any rights from this report.