Positive returns in the third quarter

“Return portfolio performed well”

Our investments are based on a long-term horizon. Enjoying your retirement already? Are you looking forward to the pension you’ll get when you retire and the pension choices you’ll be able to make? Or is your retirement far in the future because you’re a young starter at ING? No matter what phase of life you’re in, we fund your current or future pension mainly from the return realised on the pension fund’s investments. The remainder is funded by contributions paid into the pension fund (totalling 30.5%). Your employer contributes 23% to this. Your own contribution is 7.5%. That’s good to know isn’t it?

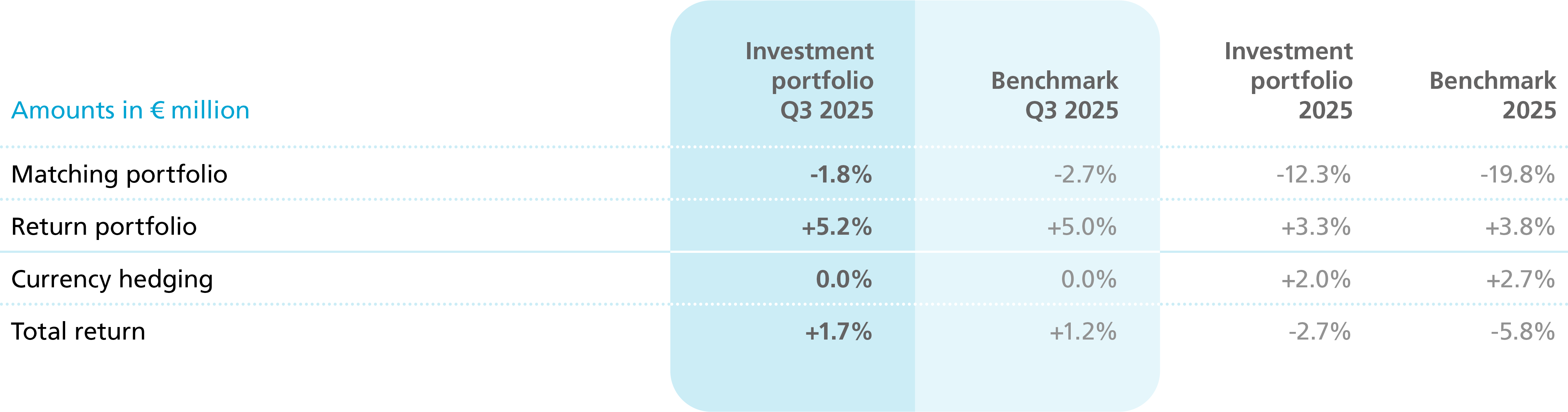

In the third quarter, the return portfolio’s performance was positive. All asset classes contributed to the result, but in particular equities, real estate, and high-yield bonds.

Performance of the overall matching portfolio was negative in the third quarter. This portfolio invests in European sovereign bonds, bonds issued by semi-government institutions, covered bonds and residential mortgages in the Netherlands. The portfolio also contains interest rate swaps and repos (short-term loans covered by collateral). An important factor impacting the value development of the matching portfolio is the development of market interest rates. When interest rates rise, bonds decrease in value.

Exchange rates play a major role in the foreign investments of the return portfolio. Our pension fund hedges a major part of the exchange fluctuations. This did not make a (significant) contribution to the portfolio return in the third quarter.

On balance, the total return was +1.7%. In the next quarterly update, you’ll read how our investments continued to develop.

We assess the return on investments by comparing it with a benchmark, which is derived from the strategic investment policy. A benchmark is a yardstick used to assess the long-term performance of the investment portfolio. The total return is a weighted average of the returns from the matching portfolio and the return portfolio.

Our fund hedges currency fluctuations to a significant extent in order to reduce the volatility of the total portfolio results and, in turn, the funding ratio. The result of this currency hedging is added to the total return.

This quarterly report has been carefully prepared. The final figures for 2025 will be published in the anual report. You cannot derive any rights from this report.