Interest rates continue to rise

“Interest rates affect your pension in the future”

How will your pension develop in 2025? How do we ensure that your pension keeps pace with price movements?

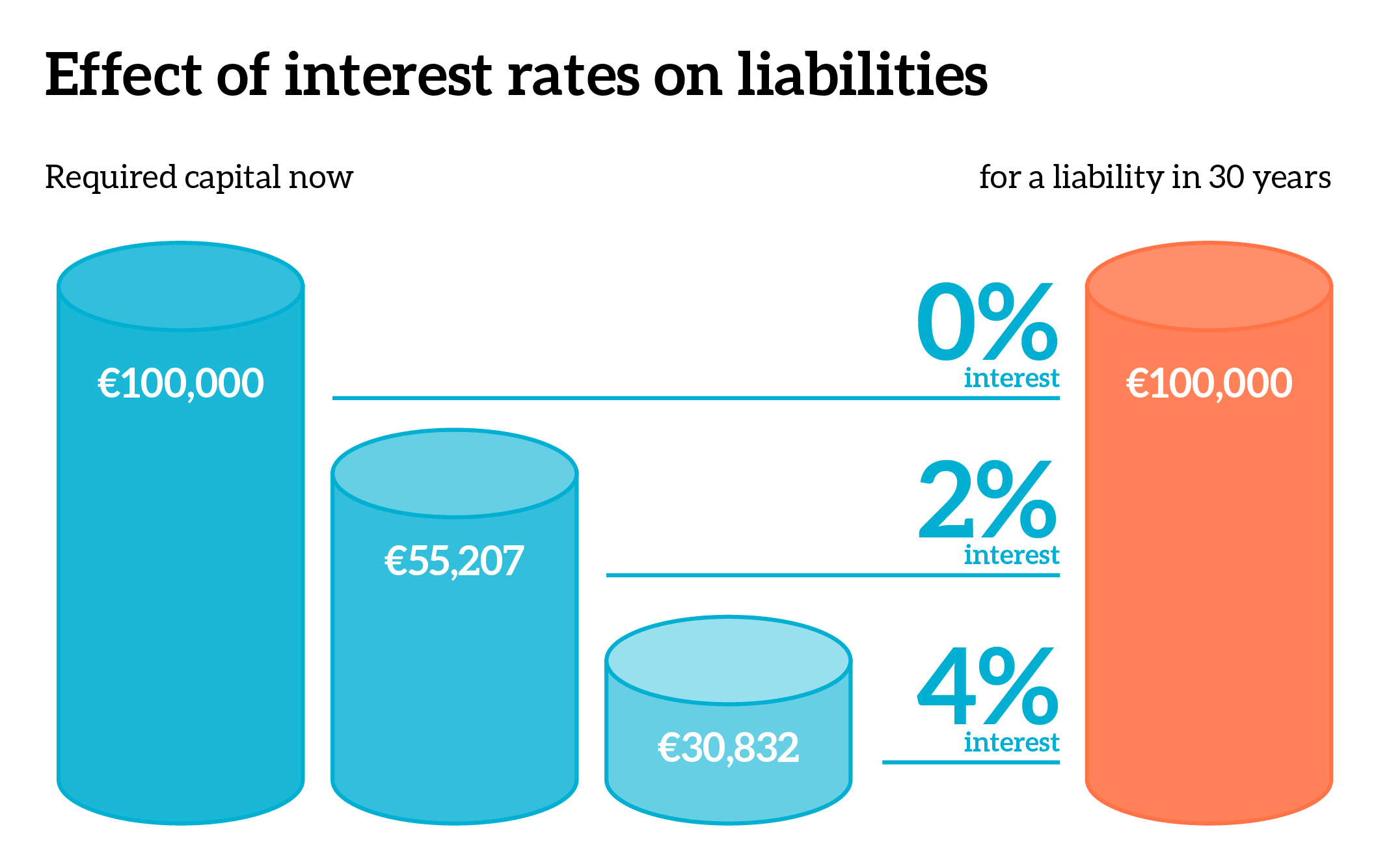

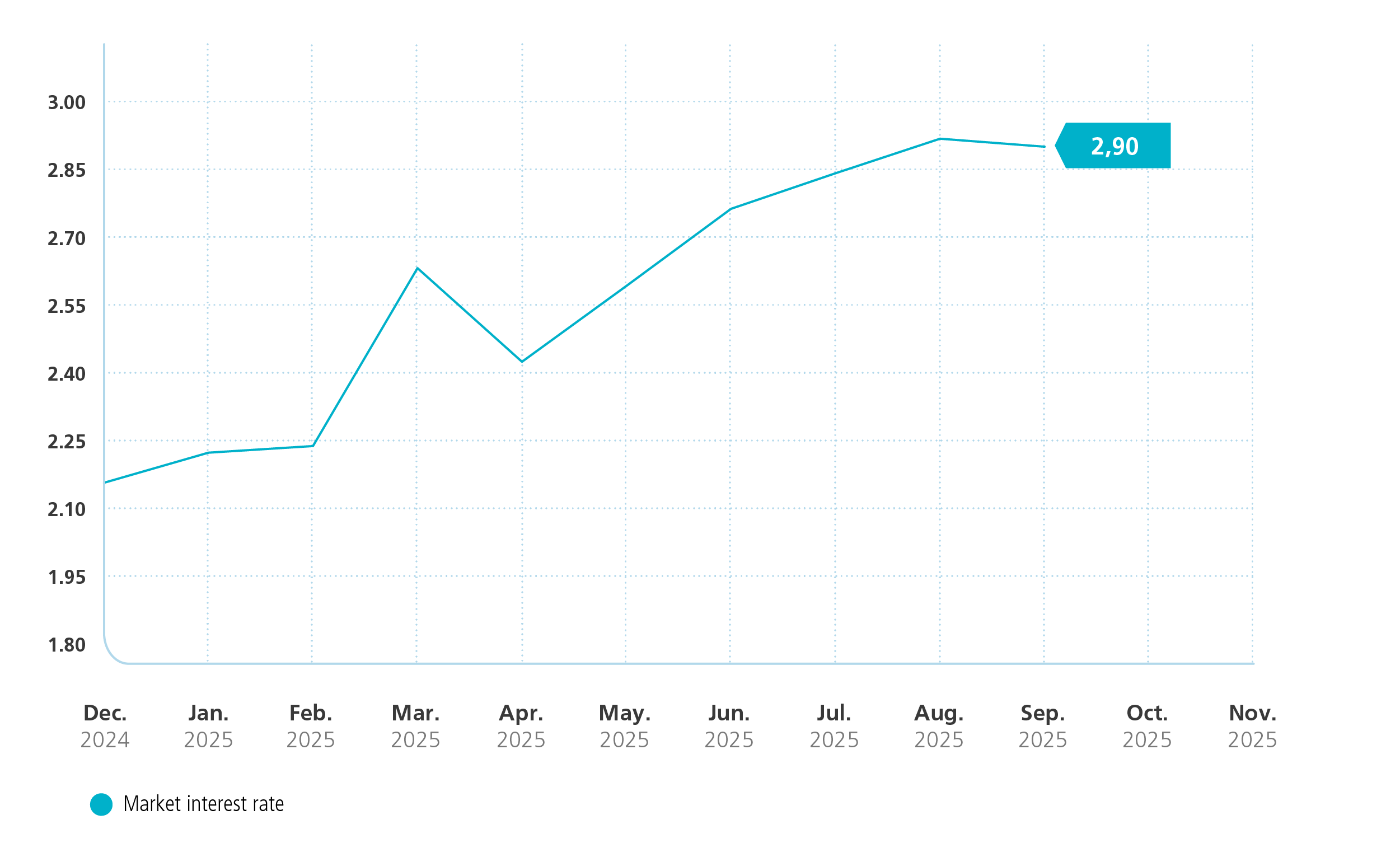

Much depends on the interest rates that pension funds use to discount their future commitments to their present value. Most of the pension payments we need to make lie far in the future. For our pension fund, the 30-year swap rate is the most important interest rate. This rose from 2.76% to 2.90% in the third quarter.

The main reason for this increase is that the series of interest rate cuts initiated by the ECB since last June has (for the time being) come to an end. In addition, there was yet another political crisis in France, and there is uncertainty about the impact of import tariffs on inflation.

Because the commitments are not fully hedged, higher interest rates are beneficial for the funding ratio. This is because the value of future commitments falls more sharply than the losses on the investments in the matching portfolio and we consequently have more money left to pay your pension in the future.

This quarterly report has been carefully prepared. The final figures for 2025 will be published in the anual report. You cannot derive any rights from this report.